dallas county texas sales tax rate

The City of DeSoto Texas 211 East Pleasant Run Road DeSoto TX 75115 Phone. The Texas sales tax rate is currently.

Tax Rates Richardson Economic Development Partnership

Dallas County is a county located in the US.

. This is the total of state and county sales tax rates. The dealer will collect motor vehicle sales tax from the purchaser when a motor vehicle is purchased from a dealer in Texas if the motor vehicle has a gross weight of 11000 pounds or less. The sales tax rate in Dallas is 825 percent of taxable goods or services sold within c ity limits.

Help us make this site better by reporting errors. Tax Office Past Tax Rates. This is the total of state and county sales tax rates.

13219 Woodbend Ln Dallas TX 75243 is listed for sale for 309900. In observance of Memorial Day Dallas County will be closed on Monday May 30 2022. The Frisco sales tax rate is.

The world-famous city of Dallas is situated within multiple. The minimum combined 2022 sales tax rate for Dallas County Texas is. The median property tax in Dallas County Texas is 2827 per year for a home worth the median value of 129700.

125 rows In Texas 123 counties impose a county sales and use tax for property tax relief. The sales tax rate does not vary. The Dallas Texas sales tax is 825 consisting of 625 Texas state sales tax and 200 Dallas local sales taxesThe local sales tax consists of a 100 city sales tax and a 100 special district sales tax used to fund transportation districts local attractions etc.

The Dallas County sales tax rate is. The base Dallas Texas sales tax rate is 1 and the Dallas Texas sales tax rate Dallas MTA Transit is 1 so when combined with the Texas sales tax rate of 625 the Dallas Texas sales tax rate totals 825. The local sales and use tax rate history shows the current and prior sales tax rates imposed by a local jurisdiction along with the effective date and end date of each tax.

City or County Rates. The county tax is collected in addition to state tax and any other local taxes city transit and special-purpose district as applicable. Please read and adhere to the Hotel Occupancy Tax Reporting Payment Requirements and Exemptions.

The dealer will remit the tax to the county tax assessor-collector. Failure to comply may result in tax liabilities fines penalties and interest. For tax rates in other cities see Texas sales taxes by city and county.

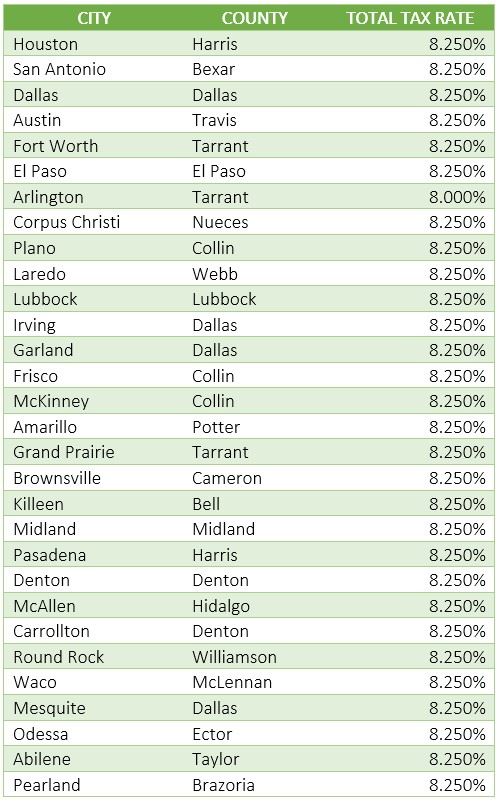

The table combines the base Texas sales tax rate of 625 and the local county rates to give you a total tax rate for each county. Below is a summary of key information. This rate includes any state county city and local sales taxes.

City or County Rates. Dallas in Texas has a tax rate of 825 for 2022 this includes the Texas Sales Tax Rate of 625 and Local Sales Tax Rates in Dallas totaling 2. It is the second-most populous county in Texas and the ninth.

The combined sales tax rate for Dallas County TX is 725. Dallas County collects on average 218 of a propertys assessed fair market value as property tax. The total sales tax rate in any given location can be broken down into state county city and special district rates.

Dallas County Coronavirus COVID-19 Information. 972-274-CITY 2489 Email Us. As for zip codes there are around 138 of them.

2020 rates included for use while preparing your income tax deduction. This is the total of state county and city sales tax rates. The Texas state sales tax rate is currently.

Wayfair Inc affect Texas. The Texas sales tax rate for most counties is 2 which means that most counties when combined. Texas Property Tax Assistance 888 743-7993 Customer Service 972 233-4929 all states.

104 rows It is the second-most populous county in Texas and the ninth-most populous in the. Learn about procedures rates and more to be prepared and get Dallas County property tax help today from Tax Ease. You can find more tax rates and allowances for Dallas and Texas in the 2022 Texas Tax Tables.

As of the 2010 census the population was 2368139. Dallas MTA Transit stands for Metropolitan Transit Authority of Dallas. Texas has a 625 sales tax and Dallas County collects an additional NA so the minimum sales tax rate in Dallas County is 625 not including any city or special district taxesThis table shows the total sales tax rates for all cities and towns in Dallas County.

The Texas Legislature passed House Bill 855 which requires state agencies to publish a list of the three. The average cumulative sales tax rate between all of them is 825. Dallas County has one of the highest median property taxes in the United States and is ranked 194th of the 3143 counties in order of median property taxes.

The counties listed below have a 05 percent sales and use tax rate unless indicated with an asterisk. The latest sales tax rate for Dallas TX. Ad Lookup TX Sales Tax Rates By Zip.

The minimum combined 2022 sales tax rate for Frisco Texas is. The 2018 United States Supreme Court decision in South Dakota v. A full list of these can be found below.

Maintenance Operations MO and Interest Sinking Fund IS Tax Rates. The most populous location in Dallas County Texas is Dallas. The December 2020 total local sales tax rate was also 6250.

For questions about HOT please call 214 670-4855 or 214 671-8508 or 214 670-4540. The Texas state sales tax rate is currently 625. The 825 sales tax rate in Dallas consists of 625 Texas state sales tax 1 Dallas tax and 1 Special tax.

Dallas County is located in Texas and contains around 21 cities towns and other locations. There is no applicable county tax. Texas has a 625 sales tax and Dallas County collects an additional NA so the minimum sales tax rate in Dallas County is 625 not including any city or special district taxes.

The Dallas Sales Tax is collected by the merchant on all qualifying sales made within Dallas. The tax is collected by the retailer at the point of sale and forwarded to the Texas Comptroller on a monthly or quarterly basis. The tax is a debt of the purchaser until paid to the dealer.

You can print a 825 sales tax table here. A private party purchaser. Texas has a lot of different counties 254 in total which is the largest number of counties within a state in the US.

It is a 005 Acres Lot 1543 SQFT 3 Beds 2 Full Baths 1 Half Baths in Cr. The current total local sales tax rate in Dallas County TX is 6250. Did South Dakota v.

Always consult your local government tax offices for the latest official city county and state tax rates. Free Unlimited Searches Try Now. The County sales tax rate is.

What is the sales tax rate in Dallas County.

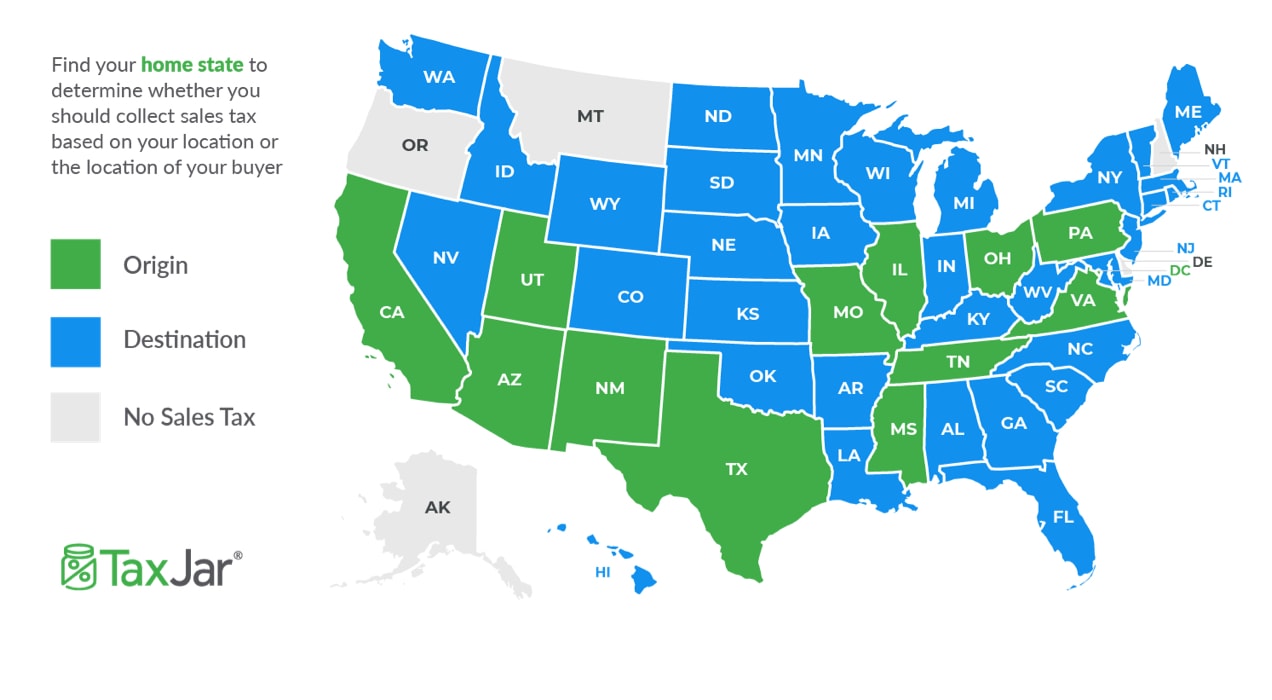

How To Charge Your Customers The Correct Sales Tax Rates

What Is The Broward County Sales Tax The Base Rate In Florida Is 6

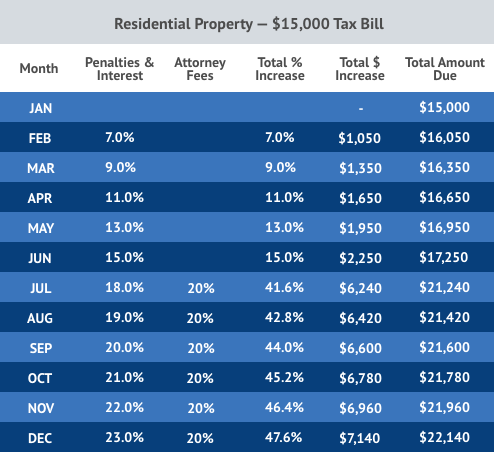

Property Tax Penalty Chart Texas Property Tax Penalties And Interest Chart Tax Ease

What The Bleep Is Going On With Texas Property Taxes Texas Monthly

What The Bleep Is Going On With Texas Property Taxes Texas Monthly

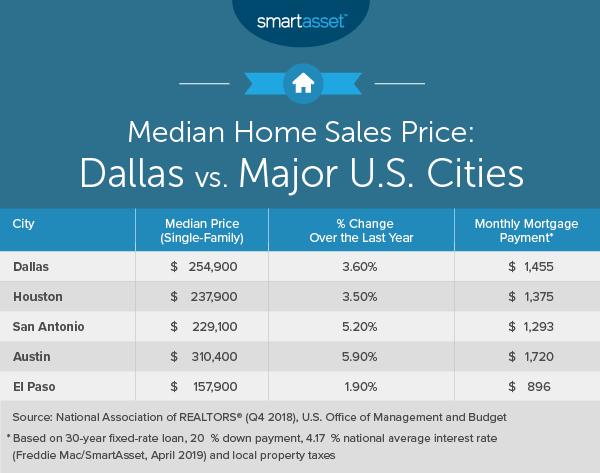

Cost Of Living In Dallas Smartasset

How To Charge Your Customers The Correct Sales Tax Rates

Tax Information City Of Sachse Official Website

Texas Sales Tax Guide For Businesses

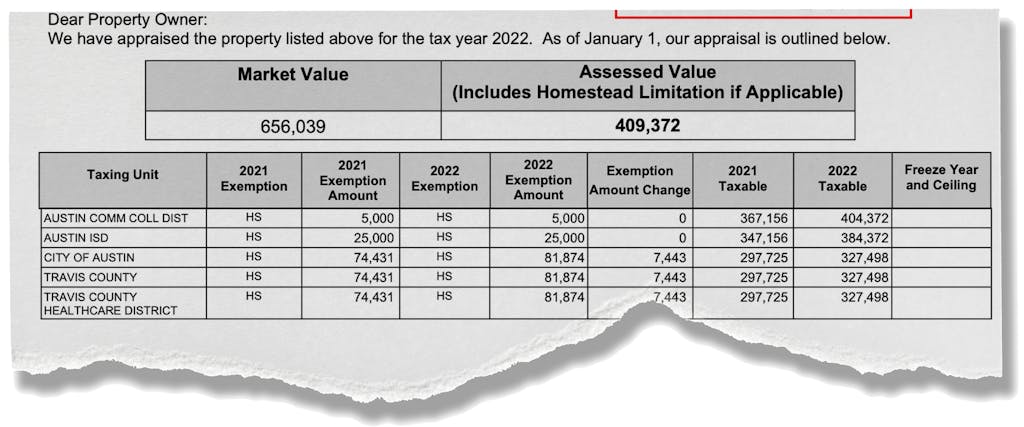

Austin Property Tax What Can You Expect When Moving Here Bhgre Homecity

What You Should Know About Dfw Suburb Property Taxes 2021 Nail Key

What You Should Know About Dfw Suburb Property Taxes 2021 Nail Key

Texas Sales Tax Guide And Calculator 2022 Taxjar

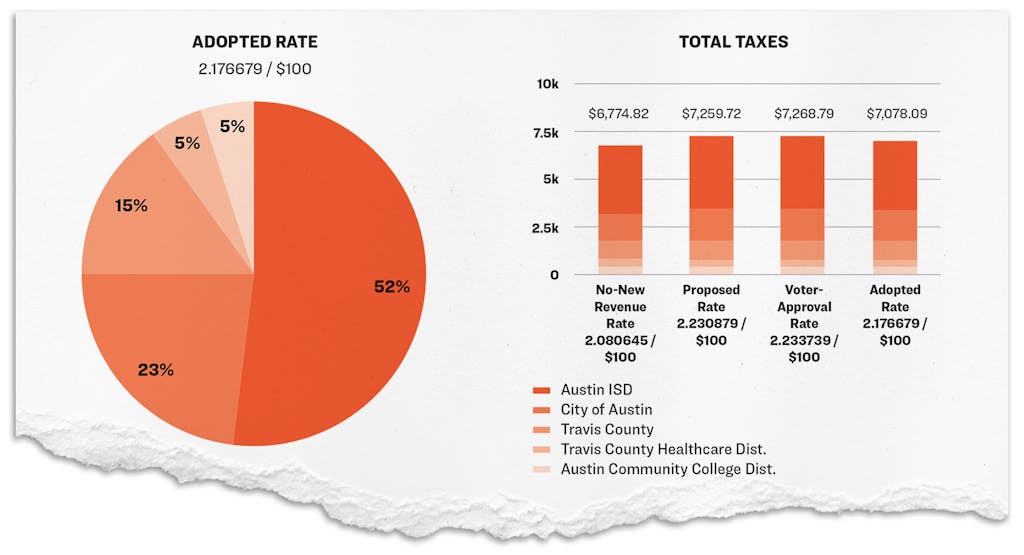

Which Texas Mega City Has Adopted The Highest Property Tax Rate

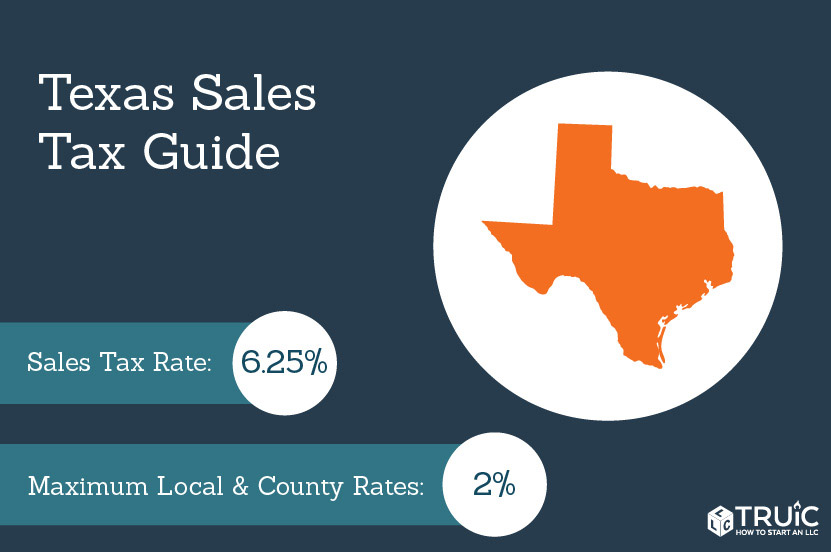

Texas Sales Tax Small Business Guide Truic

2021 2022 Tax Information Euless Tx

How To File And Pay Sales Tax In Texas Taxvalet